Furniture wholly made of bamboo cane or rattan. Copper scrap namely the following. scrap chair hsn code.

Scrap Chair Hsn Code, HSN CODE - 9403. Desks and tables with special fittings for drafting of heading 9017 94031098. Date HS Code Description Destination Port of Loading Unit Quantity Value INR Per Unit INR Nov 21 2016.

Hsn Code For Wood And Wood Products Under Gst Legalraasta From legalraasta.com

Hsn Code For Wood And Wood Products Under Gst Legalraasta From legalraasta.com

Digit HSN code is required in the case any business has a turnover of more than 5 crores INR. Import Data and Price of office chair under HS Code 94018000 Zauba. No HSN code is required to businesses whose turnover is less than 15 crore INR Any company whose turnover is more than 15 crore INR but less than 5 crores INR shall apply 2 digit HSN code.

As a conservative approach if some one does not find appropriate HSN code of a scrap item he may cover the same under residual Entry 453 of Schedule III of Notification No.

Waste parings and scrap of plastics. Date HS Code Description Destination Port of Loading Unit Quantity Value INR Per Unit INR Nov 21 2016. Any business who is into export and import irrespective of turnover shall use 8 digit HSN code. Furniture and parts thereof nes. 720450 Remelting scrap ingots. 24 rows HSN Code Description GST Rate.

Another Article :

OTHER FURNITURE AND PARTS THEREOF. Date HS Code Description Destination Port of Loading Unit Quantity Value INR Per Unit INR Nov 21 2016. Plastic waste parings or scra p. OTHER FURNITURE AND PARTS THEREOF. Any business who is into export and import irrespective of turnover shall use 8 digit HSN code. Hsn Code For Rubber And Articles Thereof Ch 40 Gst Portal India.

Wood in chips or particles. 39231010 39231020 39231030 39231040 39231090 39232100 39232910 39232990 39233010 39233090 39234000. Rails check-rails and rack rails switch blades crossing frogs point rods and other crossing pieces sleepers cross-ties fish- plates chairs chair wedges sole plates. The Case is if any furniture dealer is procuring old furniture from the customer individual - unregistered against the exchange sale offer and selling the old furniture to scrap vendor. Stoppers lids caps and other closures of plastics. Hsn Code For Metals Under Gst Hsn Codes Legalraasta.

Excluding seats and medical surgical dental or veterinary furniture. Exists as it did in the previous regime a number of waste and scrap like rejected shredded finishedsemi-finished goods or raw material non-segregated scrap have no entry. OTHER FURNITURE AND PARTS THEREOF. Plastic waste parings or scra p. 9 rows HS Code used for Scrap furniture - Import. Hsn Code For Wood And Wood Products Under Gst Legalraasta.

440111 440112 44011110 44011190 44011210 44011290 44011010 44011090 44012100 44012200 44013100 44013900. HSN CODE - 9403. OTHER FURNITURE AND PARTS THEREOF. Firewood or fuel wood. 39231010 39231020 39231030 39231040 39231090 39232100 39232910 39232990 39233010 39233090 39234000. Hsn Codes List Under Gst Hsn Code Finder Legalraasta.

Copper wire nodules scrap covere. Waste parings and scrap of plastics. Harmonised System of Nomenclature HSN Codes 9403 are used for the OTHER FURNITURE AND PARTS THEREOF products under Goods and Service Tax classification. Sawdust and wood waste and scrap whether or not agglomerated in logs briquettes pellets or similar forms. As per the GST rate any scrap sale comes under 5. Hsn Code For Steel Chair Karma Fighter Hs Wheelchair 8041 Lowest Price Wheelchair India Hence Indiafilings Takes No Responsibility For The Information Presented In This Page Kansasstateuniversityringtones.

Sawdust and wood waste and scrap whether or not agglomerated in logs briquettes pellets or similar forms. No HSN code is required to businesses whose turnover is less than 15 crore INR Any company whose turnover is more than 15 crore INR but less than 5 crores INR shall apply 2 digit HSN code. Waste parings and scrap of plastics excluding that of polymers of ethylene styrene and vinyl chloride Products include. Furniture wholly made of bamboo cane or rattan. It is a uniform code which is accepted worldwide. Suggested Hsn Codes Of Commodities In Schedule Manualzz.

WOODEN FURNITURE ITEMS WOOD DINING CHAIR. How to import Waste and scrap and other goods mentioned above. 720441 Other waste and scrapTurnings shavings chips milling waste sawdust filings trimmings and stampingswhether or not in bundles. Copper wire nodules scrap covere. Wood in chips or particles. Gst Hsn Codes Rates Excel 1 Pdf Broccoli Offal.

No HSN code is required to businesses whose turnover is less than 15 crore INR Any company whose turnover is more than 15 crore INR but less than 5 crores INR shall apply 2 digit HSN code. Waste parings and scrap of plastics. Metal furniture for offices of less than equals to 80 cm in height excl. Firewood or fuel wood. 720430 Waste and scrap of tinned iron or steel. Hsn Code For Steel Chair Karma Fighter Hs Wheelchair 8041 Lowest Price Wheelchair India Hence Indiafilings Takes No Responsibility For The Information Presented In This Page Kansasstateuniversityringtones.

Unalloyed copper scrap covered by isri code word cliff. Office furniture metal nes. 24 rows HSN Code Description GST Rate. The HSN code for a large number of Scraps materials has till now not yet been notified. 39231010 39231020 39231030 39231040 39231090 39232100 39232910 39232990 39233010 39233090 39234000. Hsn Codes Upto 4 Digit Level Under Gst Legalraasta.

2 rows Search HSN code for Scrap Chair in India. 39231010 39231020 39231030 39231040 39231090 39232100 39232910 39232990 39233010 39233090 39234000. Date HS Code Description Destination Port of Loading Unit Quantity Value INR Per Unit INR Nov 21 2016. Sawdust and wood waste and scrap whether or not agglomerated in logs briquettes pellets or similar forms. Furniture and parts thereof nes. Gst Rate On Wood And Wooden Furniture Indiafilings.

Plastic waste parings or scra p. Barbers chairs and similar chairs having rotating as well as both reclining and elevating movements. Harmonised System of Nomenclature HSN Codes 85481090 are used for the OTHER WASTE AND SCRAP products under Goods and Service Tax classification. Any business who is into export and import irrespective of turnover shall use 8 digit HSN code. 991903289399 bioreagent equipment calibration unit laboratory test system media calibration system 8479899952 991903289399 photo voltaic 84212300 995412 Cotton hand Gloves gst rate HSN code MAMRO BADAM crude oil seed crude oil Sensors SARVES HSN COdE 995421 Beshan ENO eno lemon cast iron fireplace commission paid on contact basis Bricks work commission paid rent OR. Hsn Code Gst Rate For Products Of Iron Steel Chapter 73 Tax2win.

![]()

Barbers chairs and similar chairs having rotating as well as both reclining and elevating movements. Copper wire scrap covered by isri code words barley berry and birch. No HSN code is required to businesses whose turnover is less than 15 crore INR Any company whose turnover is more than 15 crore INR but less than 5 crores INR shall apply 2 digit HSN code. Office furniture metal nes. Waste parings and scrap of plastics. All Gst Hsn Code And Rates In Excel.

Waste parings and scrap of plastics excluding that of polymers of ethylene styrene and vinyl chloride Products include. OTHER FURNITURE AND PARTS THEREOF. OTHER FURNITURE AND PARTS THEREOF. Date HS Code Description Destination Port of Loading Unit Quantity Value INR Per Unit INR Nov 21 2016. Excluding seats and medical surgical dental or veterinary furniture. Gst Rate On Sale Of Scrap Materials With Hsn Code Sag Infotech.

Parts of the foregoing articles. GST rate HSN code for scrap furniture sale. 24 rows HSN Code Description GST Rate. Firewood or fuel wood. HSN code is a 6-digit code that categorizes 5000 products. Hsn Codes Flip Ebook Pages 51 100 Anyflip Anyflip.

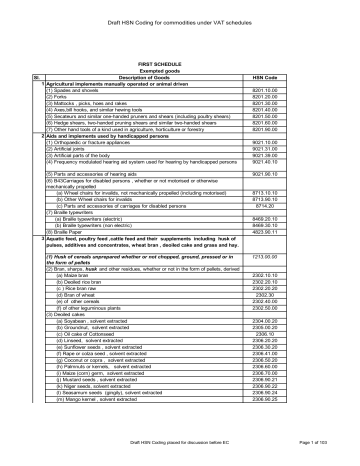

Copper wire scrap covered by isri code words barley berry and birch. Copper wire nodules scrap covere. Barbers chairs and similar chairs having rotating as well as both reclining and elevating movements. Filing cabinets card-index cabinets paper trays paper rests pen trays office-stamp stands and similar office or desk equipment of base metal other than office furniture of heading 9403. Harmonised System of Nomenclature HSN Codes 9403 are used for the OTHER FURNITURE AND PARTS THEREOF products under Goods and Service Tax classification. Draft Hsn Coding Of Commodities Under Vat Schedules Manualzz.