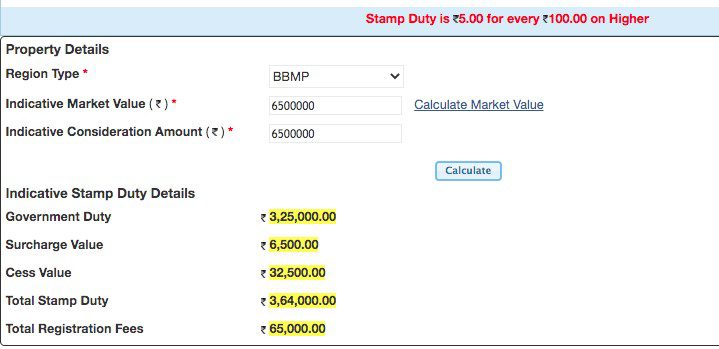

Anita will also have to pay a cess charged at 10 of the stamp duty amounting to Rs 44800 and another surcharge calculated at 2 of the stamp duty which will come up to Rs. The registration charge is 1 of the value of the property while 10 of the stamp duty is the BBMP Village Areas and BMRDA added cess. apartment registration charges in bangalore.

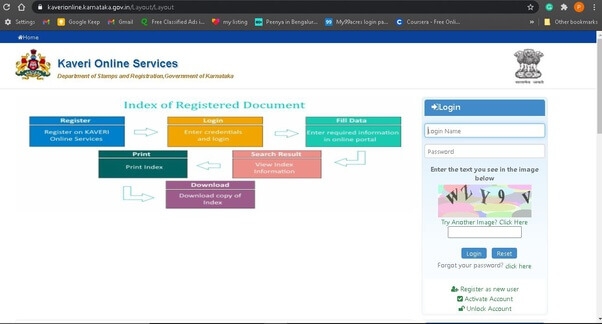

Apartment Registration Charges In Bangalore, Apartment registration cost in bangalore is a summary of the best information with HD images sourced from all the most popular websites in the world. The saleable value of a property in simple ways is the product of the property size and the guideline value. The following is the step by step procedure Kaveri Online is a government initiative for stamps registration Step 1.

What Are The Stamp Duty Registration Charges In Bangalore From housing.com

What Are The Stamp Duty Registration Charges In Bangalore From housing.com

However to promote affordable housing from April 1 2020 stamp duty on new flats costing less than Rs. The registration charge for properties in Bangalore is calculated at 1 of the property value irrespective of the price of the property or the ownership malefemalejoint ownership. 1 of the property value.

Besides stamp duty you will have to reserve a budget for the cess and surcharge.

Find the best offers for flat bangalore registration charges. In exercise of the powers conferred by section 78 of the Registration Act 1908 Act XVI of 1908 and in supersession of the orders issued in GOMsNo757 Revenue Regn-I Department dated. August 10 2021 1022 AM Reply. 1 of the property value. 1 of the property value. Of all and only registration charges extra.

Another Article :

How can I pay stamp duty and registration charges in Bangalore. The table below shows various charges applicable on property registration in Bangalore. 1 of the property value. Other charges such as registration fees and transfer charges in case of resale property would be levied. The state government has reduced the registration fee from 5 percent to 3 percent for flats costing less than 20 Lakh. Property Registration Charges In Bangalore 2019 Commonfloor.

1 of the property value. 1 of the property value. Furthermore the state government will levy registration charges at 1 of the property value amounting to Rs 80000. Buyers in Bangalore have to pay 1 of the deal value as the registration charge. This registration rate also applies to. Site Registration Charges In Bangalore Site Registration Fees.

18122001 and as subsequently amended from time to time and also the order issued in GOMsNo. I paid Rs360 only towards scanning charges. Besides stamp duty you will have to reserve a budget for the cess and surcharge. As per the ongoing rates one. All I had to run for before I went to the government office was to. Flat Land And Property Stamps And Registration Charges In Bangalore And India Basunivesh.

Consider a 1 acre apartment complex housing about 50 flats each of which is about 1500 sq. The most important cost component is the undivided share UDS of the land which is proportionate to the built-up area of the individual apartment. So what are the stamp duty and registration charges in Bangalore. The UDS would be 43560 sq. The saleable value of a property in simple ways is the product of the property size and the guideline value. Property Stamp Duty Registration Charge 2019 2020 Update.

The following is the step by step procedure Kaveri Online is a government initiative for stamps registration Step 1. Of all and only registration charges extra. 3 BHK 1280 SQFT flat for Sale in 2nd Floor 9700000- Registration Charges 3 BHK Flat in. Call up people to understand the process. 2 3bhk flats for sale in kr puram with all amenities 63l and excluding govt registration charges if your interested to visit or for more detail. Calculate Stamp Duty And Registration Charges On Property.

In this article we discuss how much money you will have to pay as stamp duty and registration charge if you are buying a property in Bangalore. 1 of the deal value. You can pay these charges in the sub-registrars office through the following means for property registration in Bangalore. The most important cost component is the undivided share UDS of the land which is proportionate to the built-up area of the individual apartment. The stamp duty rates in Bangalore and property registration charges in Bangalore are things you should know while applying for home loan and choosing your desired property. What Is The Stamp Duty Charge In Bangalore Real Estate.

These charges vary from state to state. 18122001 and as subsequently amended from time to time and also the order issued in GOMsNo. Karnataka Government has given a leg up to the realty sector by reducing the property registration charges in Bangalore. Stamp duty and registration charges are important costs which every buyer has to pay while planning to buy his dream home. One can find the cost of such stamp duty and registration charges in Karnataka Government Portal. What Are The Stamp Duty Registration Charges In Bangalore.

1 of the total property value. 1 of the property value. The most common among these expenses are stamp duty and registration charges on the property. Karnataka announces stamp duty cut. This registration rate also applies to. Property Registration Charges In Bangalore Know Details.

The registration fee is however 1 of the saleable value. The UDS would be 43560 sq. Furthermore the state government will levy registration charges at 1 of the property value amounting to Rs 80000. How the Flat Land and Property Stamp duty and Registration charges are calculated. These charges vary from state to state. What Are The Stamp Duty And Registration Charges In Bangalore Tesz.

These charges vary from state to state. Open the website Kaveri Online Services Step 2. In some states women and senior citizens get a discount on both. 1 of the property value. 1 of the deal value. Ap Property Land Registration Online Procedure Charges In Andhra Pradesh.

I paid Rs360 only towards scanning charges. All I had to run for before I went to the government office was to. Get the demand drafts towards registration and stamp duty. The most common among these expenses are stamp duty and registration charges on the property. 25072012 the Governor of Andhra Pradesh hereby notifies the. Property Registration Charges In Bangalore 2018 19 Stamp Duty Calculator Zippserv Blog.

Flat Land And Property Stamps And Registration Charges In apartment registration cost in bangalore. Furthermore the state government will levy registration charges at 1 of the property value amounting to Rs 80000. The registration fee is however 1 of the saleable value. Karnataka Government has given a leg up to the realty sector by reducing the property registration charges in Bangalore. Karnataka announces stamp duty cut. Know About Stamp Duty Registration Charges In Kolkata.

Karnataka Government has given a leg up to the realty sector by reducing the property registration charges in Bangalore. Of all and only registration charges extra. Get the documents in order. The UDS would be 43560 sq. 1 of the property value. What Are The Stamp Duty Registration Charges In Bangalore.

Of all and only registration charges extra. You can pay these charges in the sub-registrars office through the following means for property registration in Bangalore. The state government has reduced the registration fee from 5 percent to 3 percent for flats costing less than 20 Lakh. The registration fee is however 1 of the saleable value. Find the best offers for flat bangalore registration charges. What Are The Stamp Duty Registration Charges In Bangalore.

Stamp duty and registration charges are important costs which every buyer has to pay while planning to buy his dream home. How can I pay stamp duty and registration charges in Bangalore. All I had to run for before I went to the government office was to. However to promote affordable housing from April 1 2020 stamp duty on new flats costing less than Rs. 25072012 the Governor of Andhra Pradesh hereby notifies the. How To Calculate Registration Charges On Property In Bangalore Property Walls.